- Pareto Tech Insights

- Posts

- Why AI Rollouts Are Stalling — And What It Means for Finance

Why AI Rollouts Are Stalling — And What It Means for Finance

Goldman Sachs and other major banks are slowing their AI launches as regulators tighten control. The question now isn’t whether AI will transform finance but how much regulation will reshape that transformation.

The Roadblock No One Predicted

Goldman Sachs has spent years investing in AI for trading and risk management. But after new SEC rules arrived in 2023, the firm decided to pause:

delayed its rollout

expanded its audit teams

absorbed higher costs.

Across finance, AI offers precision and profit, but regulators worry that the same tools could amplify systemic risk. When too many firms rely on the same base models, a single failure can ripple across the market.

Why it matters: Regulation aims to prevent that fragility from turning into a crisis.

In the U.S.: Transparency or Trouble?

Since 2023, the SEC has required investment firms to prove their AI models don’t create conflicts of interest.

Leading to:

More compliance staff

Longer testing cycles

Slower launches.

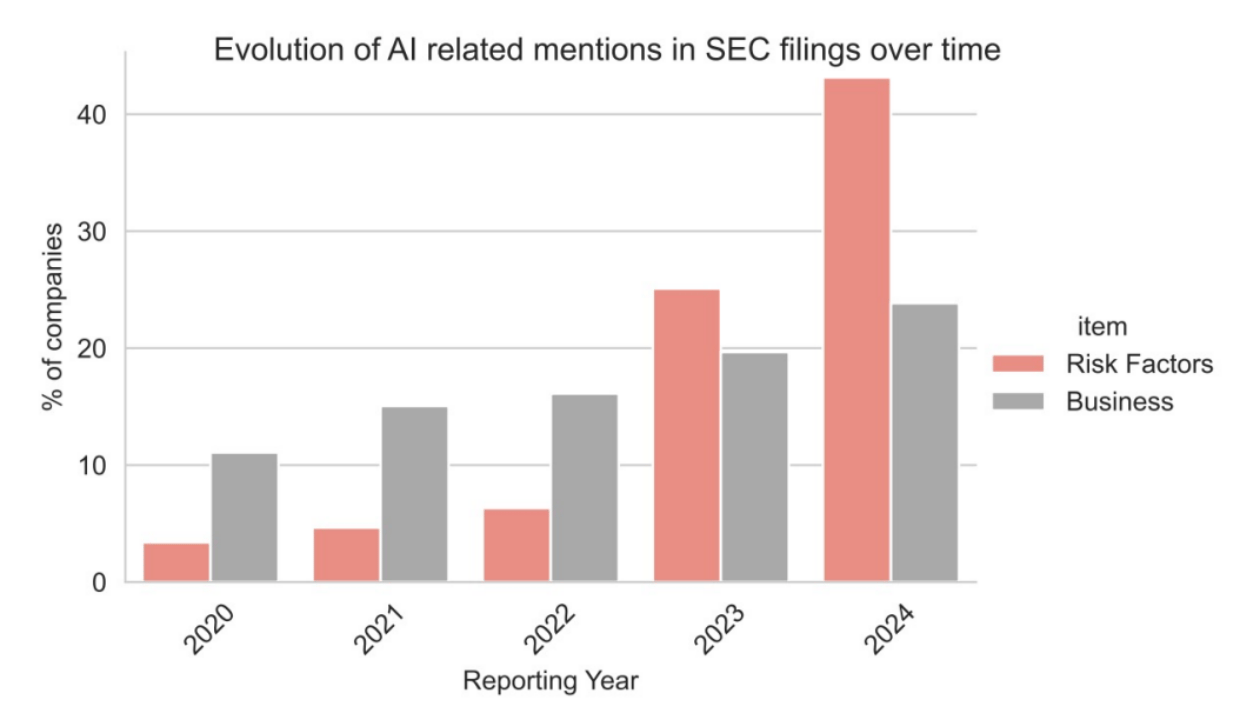

Figure 1 - Frequency of AI-related mentions (SEC, 2024)

SEC Chair Gary Gensler warns that relying on just a few base models promotes “herding” behavior: when thousands of firms make similar moves based on similar signals.

That’s the same dynamic behind past market crashes.

In short, oversight may make AI safer, but it’s also making innovation slower.

In China: A Different Kind of Barrier

China’s Algorithm Regulation forces foreign banks to:

Keep data stored locally

Disclose algorithmic details to the government.

For J.P. Morgan, that means running a separate AI system in China, increasing costs, and reducing efficiency.

What was once a promise of global integration has become a puzzle of local compliance.

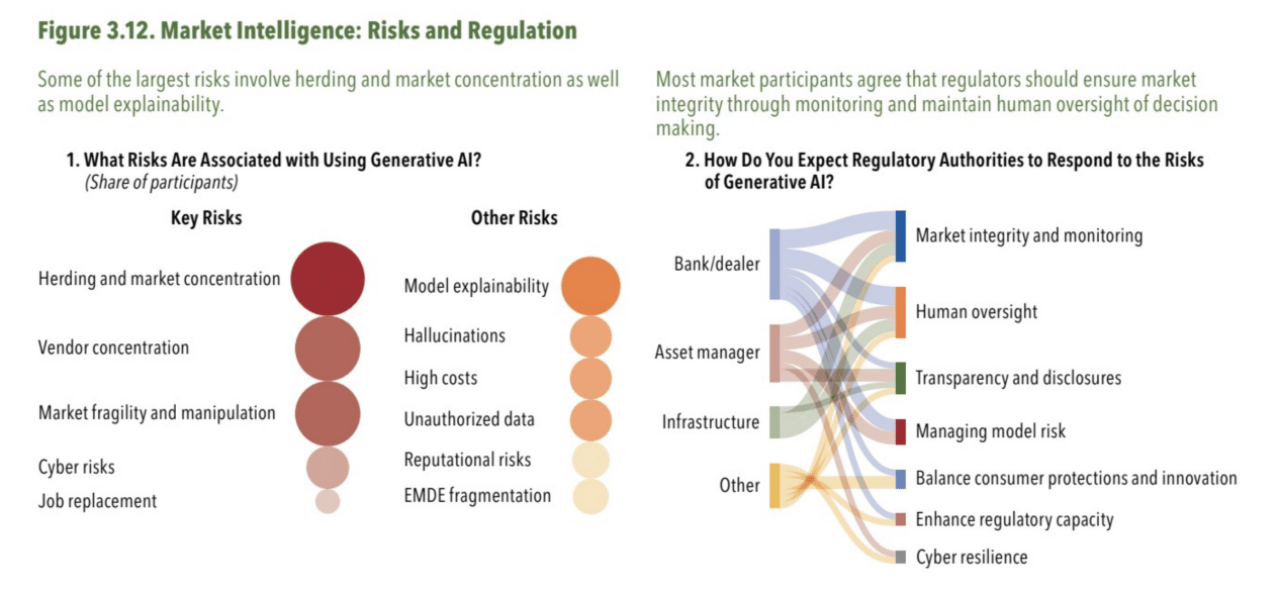

Figure 2 - Participants’ views on AI-related risks and regulatory responses (IMF, 2024)

What the Data Says

Regulators worldwide are moving faster than AI systems can adapt.

Event studies show that AI-related policy announcements now move stock prices — proof that compliance risk is becoming investment risk.

The data points to a consistent pattern:

Higher compliance costs cut into short-term profits

Transparency requirements reduce model risk

Reliance on shared models increases systemic risk

Pareto’s Take: Optimization Under Pressure

At Pareto Technology, the goal isn’t to avoid regulation but to optimize within it. Using advanced meta-heuristic algorithms, firms can find balance:

Profitability

Compliance

Stability.

Warning: when everyone chases the same “optimal” strategy, the market can grow vulnerable again.

The Big Picture

AI’s growth in finance isn’t slowing because of technology, but because of policy. Regulation now shapes how—and how fast—innovation happens.

The Takeaway:

The winners in this new landscape will be those who treat compliance not as a constraint, but as a design principle for smarter, safer AI.

Works Cited

Carnegie Endowment for International Peace. (2022). China’s algorithm regulation: The world’s first. https://carnegieendowment.org/2022/01/20/china-s-algorithm-regulation-world-s- first-pub-86229

Gensler, G. (2024). AI, finance, movies, and the law — Prepared remarks before the Yale Law School. U.S. Securities and Exchange Commission. https://www.sec.gov/newsroom/speeches-statements/gensler-ai-021324

International Monetary Fund. (2024). Global financial stability report: Artificial intelligence and financial stability. IMF. https://www.imf.org/en/Publications/GFSR

Mollman, S. (2025). Goldman Sachs bets generative AI empowers ‘AI natives,’ says CFO. Fortune. https://fortune.com/2025/07/07/goldman-sachs-bets-generative-ai-empowers-ai-n atives-cfo/

U.S. Department of the Treasury. (2024). FSOC discusses financial stability implications of artificial intelligence. U.S. Department of the Treasury. https://home.treasury.gov/news/press-releases/jy1987

U.S. Securities and Exchange Commission. (2023). Conflicts of interest associated with the use of predictive data analytics by broker-dealers and investment advisers (Release No. 34-97990; File No. S7-12-23). Federal Register, 88(142), 51860–51911. https://www.sec.gov/files/rules/proposed/2023/34-97990.pdf