- Pareto Tech Insights

- Posts

- US Tariffs and Global Trade: Rethinking in Investment Strategy with Crypto

US Tariffs and Global Trade: Rethinking in Investment Strategy with Crypto

Recent tariff legislations disrupt markets, crypto offers new tools for diversification and strategy in a shifting trade landscape.

Trump Tariff Regulations

Before:

U.S. tariffs averaged 3.3%, lower than the EU (5%) and China (7.5%).

In response, China now taxes 58.3% of U.S. imports (worth ~$90B), while failing to meet earlier commitments to buy U.S. goods under the 2020 deal.

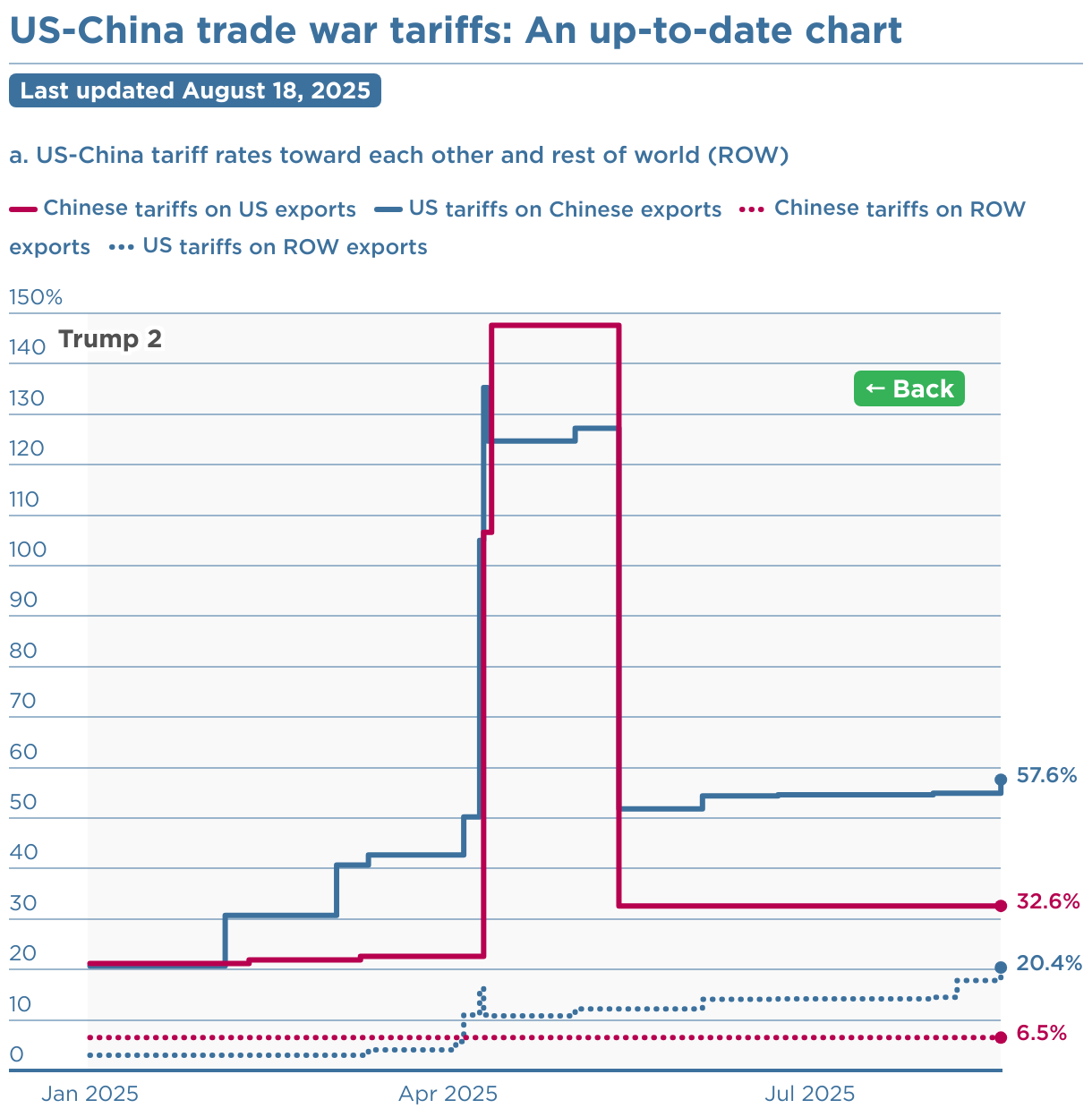

Figure 1 US-China Trade War Tariffs: An Up-to-Date Chart (Bown)

Legislation changes:

April 2 → Trump announces a 10% minimum tariff on all imports, with targeted hikes on China, EU, Japan, and South Korea.

April 4 → China retaliates with a 34% tariff on U.S. goods, escalating tensions.

April 9 → Trump narrows tariff scope for most countries—but slaps China with a 145% tariff as a direct countermeasure.

Why It Matters for the U.S.

Trump’s goal is to boost domestic manufacturing and “level the playing field.” But the effects are far-reaching:

Tariffs = higher import costs → inflation rises, GDP cut by 0.5–1% annually.

Reduced foreign investment → bond yields rise and borrowing costs increase.

On April 2, the S&P 500 plunged 12.1%, reflecting immediate market stress.

U.S. manufacturing output has declined from 28.4% in 2001 to 17.4% in 2023. Tariffs are intended to reverse that trend while generating $5.2T in revenue over 10 years.

Global Ripple Effects

EU Response: Ongoing negotiations have led to tariff reductions on certain goods, with the EU agreeing to lower car tariffs in exchange for U.S. concessions.

China’s Stance: Beijing has matched U.S. tariffs with steep retaliatory measures, raising barriers on American agricultural and tech exports.

Supply Chain Disruptions: Higher costs ripple through industries from autos to semiconductors, intensifying inflationary pressure worldwide.

Geopolitical Risk: Persistent trade tensions risk fracturing alliances and deepening divisions in global trade blocs.

Implications for Investors

Different asset classes feel the impact in unique ways:

Equities → Higher costs reduce corporate profits, leading to lower valuations and heightened volatility.

Bonds → Reduced foreign inflows lift U.S. bond yields → higher borrowing costs and weaker bond performance.

Dollar → Declining investment demand weakens the dollar’s purchasing power.

Crypto → Gains traction as a hedge against equity sell-offs, inflation, and dollar weakness.

Crypto in Focus

Figure 2 Net inflows to ether and bitcoin ETFs (Macheel)

Despite volatility, crypto has shown resilience amid tariff turbulence:

Bitcoin -5.3% on April 3 (short-term shock).

Ethereum +144% and Bitcoin +39% from April–August (medium-term strength).

Why Crypto Stands Out

Immune to tariffs: no physical trade barrier.

Functions as digital gold → a hedge in downturns.

Decentralized infrastructure shields it from government trade policies.

Increasingly global adoption adds liquidity even when traditional markets tighten.

Looking Ahead

Short Term: Expect heightened volatility as tariff negotiations evolve and retaliatory measures escalate.

Medium Term: Inflationary pressures and weaker dollar fundamentals may fuel further demand for crypto.

Long Term: If tariffs persist, institutional adoption of digital assets could accelerate as investors reallocate toward non-sovereign, borderless stores of value.

Trump’s tariffs may boost U.S. manufacturing in theory, but the costs—higher inflation, weaker capital flows, and trade retaliation—pose real risks. For investors, diversification is essential. Cryptocurrency offers a unique hedge, protecting portfolios against equity volatility and a weakening dollar in a turbulent global economy.

Works Cited

Basulto, Dominic. “Is This Cryptocurrency the Biggest Winner of Trump’s Tariffs? (Spoiler Alert: It’s Not Bitcoin).” The Motley Fool, 12 August 2025, https://finance.yahoo.com/news/cryptocurrency-biggest-winner-trumps-tariffs-100900765.html. Accessed 25 August 2025.

BOAK, JOSH. “Trump limits tariffs on most nations for 90 days, raises taxes on Chinese imports.” AP News, 9 April 2025, https://apnews.com/article/trump-tariffs-stock-market-china-recession-deals-e8e54a68397e6829e1d27552a1d7bfb9. Accessed 25 August 2025.

Bown, Chad P. “US-China Trade War Tariffs: An Up-to-Date Chart.” Peterson Institute for International Economics, 2025, https://www.piie.com/research/piie-charts/2019/us-china-trade-war-tariffs-date-chart. Accessed 25 August 2025.

Clarke, Jennifer. “What are tariffs, how do they work and why is Trump using them?” BBC, 11 August 2025, https://www.bbc.com/news/articles/cn93e12rypgo. Accessed 25 August 2025.

Conlon, Sean, and Pia Singh. “Stock market news for April 28, 2025.” CNBC, 2025, https://www.cnbc.com/2025/04/27/stock-futures-slip-ahead-of-busy-earnings-week-live-updates.html. Accessed 25 August 2025.

Hersh, Adam S., and Josh Bivens. “Tariffs — Everything you need to know but were afraid to ask.” Economic Policy Institute, 10 February 2025, https://www.epi.org/publication/tariffs-everything-you-need-to-know-but-were-afraid-to-ask/. Accessed 25 August 2025.

Macheel, Tanaya. “Crypto wobbles into August as Trump’s new tariffs trigger risk-off sentiment.” CNBC, 1 August 2025, https://www.cnbc.com/2025/08/01/crypto-market-today.html. Accessed 25 August 2025.

Mackintosh, James. “Who Will Pay the Price for Trump’s Economic Goals?” The Wall Street Journal, 19 April 2025, https://www.wsj.com/finance/investing/who-will-pay-the-price-for-trumps-economic-goals-37a7df15?mod=author_content_page_1_pos_5. Accessed 25 August 2025.

Penn Wharton. “The Economic Effects of President Trump’s Tariffs — Penn Wharton Budget Model.” Penn Wharton Budget Model, 10 April 2025, https://budgetmodel.wharton.upenn.edu/issues/2025/4/10/economic-effects-of-president-trumps-tariffs. Accessed 25 August 2025.

Sozzi, Brian. “Why the tariff relief stock rally isn’t shaking Wall Street’s biggest bear.” Yahoo Finance, 28 April 2025, https://finance.yahoo.com/news/why-the-tariff-relief-stock-rally-isnt-shaking-wall-streets-biggest-bear-123340859.html. Accessed 25 August 2025.

The White House. “Fact Sheet: President Donald J. Trump Declares National Emergency to Increase our Competitive Edge, Protect our Sovereignty, and Strengthen our National and Economic Security.” The White House, 2 April 2025, https://www.whitehouse.gov/fact-sheets/2025/04/fact-sheet-president-donald-j-trump-declares-national-emergency-to-increase-our-competitive-edge-protect-our-sovereignty-and-strengthen-our-national-and-economic-security/. Accessed 25 August 2025.