- Pareto Tech Insights

- Posts

- Monetary Divergence and the Next EM Debt Crisis

Monetary Divergence and the Next EM Debt Crisis

The Fed’s rate increased interest rates are hitting emerging markets (EMs) hard.

Introduction

The Fed’s rate increased interest rates are hitting emerging markets (EMs) hard. Rising dollar debt, capital outflows, and weak local currencies are stressing these economies—and investors. But as cracks form, crypto, especially stablecoins, is gaining traction as a new global backdoor to the dollar.

Why Does This Matter?

Emerging markets make up 40% of global GDP. When they are struggling, everyone feels it — from bond markets in New York to ETFs in London.

Fed Hikes: How Did We Get Here?

Since 2022, the Fed has aggressively raised interest rates to fight inflation — hiking borrowing costs across the globe.

Why: Inflation spiked post-COVID due to supply chain chaos and tight labor markets.

The result: EMs are struggling with dollar debt, capital flight, and slower growth.

Key Insight: Rate hikes to cool inflation are far more disruptive than hikes during U.S. economic booms. When the Fed tightens in a strong economy, EMs benefit from export demand. But when it's about inflation? EMs economy crashes.

EMs on a Tightrope

Here’s what’s tying their hands:

Weak central banks and shallow capital markets

Limited foreign exchange reserves (can't defend their currencies)

High external debt (especially in dollars)

When EMs raise their own rates to keep up = they kill growth.

They don't raise their rates = capital leaves and currencies crash.

This negative loop makes it almost impossible to escape without external help.

The Dollar-Debt Doom Loop

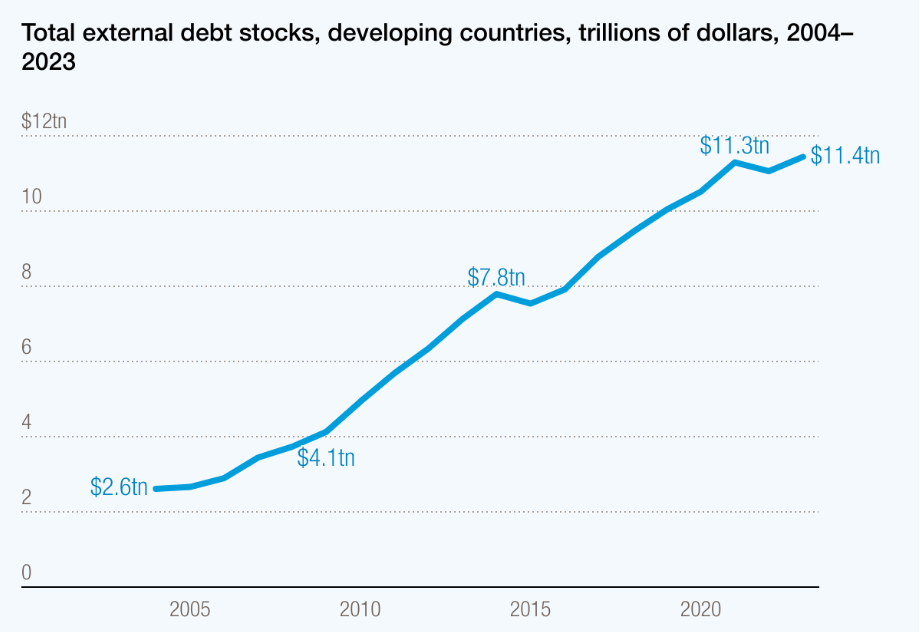

Diagram 1: Total External Debt Stocks, Developing Countries, Trillions of Dollars, 2004-2023 (UNCTAD)

EMs owe $11.4 trillion in external debt — 99% of their export earnings.

When the dollar strengthens, debt payments balloon.

Credit downgrades → higher yields → investor panic → more outflows.

IMF help comes with painful conditions: austerity, tax hikes, and spending cuts that slow long-term growth and hurt basic services like healthcare and education.

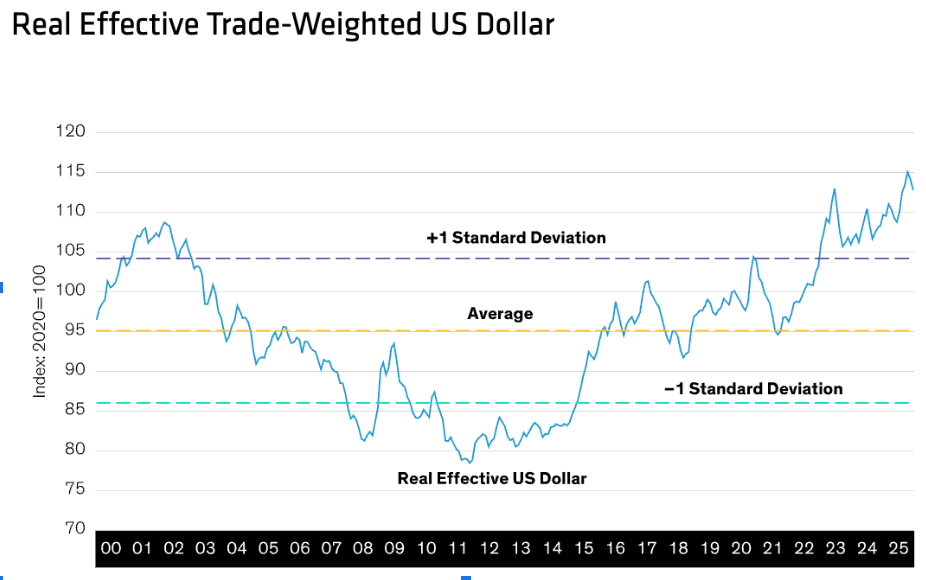

The US Dollar Is Relatively Overvalued

Diagram 2: Real Effective Trade-Weighted US Dollar (Haman et al.)

How This Stress Spreads Globally

Diagram 3: Impact of Spillovers on Global GDP by G20 Emerging Markets in Percent (Mammadov)

Even if you’re not in an EM, you’re not safe. Here’s why:

Global Bond Contagion

ETF outflows trigger massive sell-offs.

Bond prices fall. Yields spike everywhere — not just in EMs.

Bank & Fund Exposure

Foreign banks hold EM bonds and derivatives.

Losses in one EM = ripple effects in global portfolios.

Shadow Banking Risk

Hedge funds & non-bank lenders face margin calls and fire sales.

Hidden leverage spreads risk silently.

Offshore Trouble

Much of EM borrowing happens in Cayman Islands/London via opaque SPVs.

These offshore dollar pipelines are under-regulated — and explosive during crises.

Enter: Stablecoins & Crypto

Diagram 4: Top 20 Ranking Countries In the Crypto Adoption Index (Franklin Templeton Fixed Income 2).

When local currencies collapse or governments impose capital controls, crypto steps in:

Stablecoins (USDT, USDC) are used in EMs to:

Store savings in dollars

Send remittances

Pay for imports

47% of crypto users in EMs use stablecoins to save in USD

$3.7 trillion in stablecoin transactions in 2023

50–70% of public blockchain volume is now stablecoins

For investors: This is a hedge and a growth story.

Investor Playbook

Tactical opportunities:

EM bond dislocations = chance for high-risk alpha

Long-term gains in local-currency debt if stabilization occurs

Strategic hedging:

Diversify with gold, inflation-linked bonds

Crypto (esp. stablecoins) as a hedge against sovereign risk

Final Thought

Emerging markets are under pressure. They can’t keep up with Fed hikes, and their economies are getting squeezed. But in the cracks of old systems, new ones are growing. Crypto — especially Stablecoins — may not just be a hedge. It could be the future.

Work Cited

Castle Island Ventures, and Brevan Howard Digital. “Stablecoins: The Emerging Market Story.” 2024, pp. 1-31.

Cleasby, Robert. “Banking on Growth: The Role of Foreign Banks in Emerging Markets.” Finextra, 202, https://www.finextra.com/blogposting/23093/banking-on-growth-the-role-of-foreign-banks-in-emerging-markets. Accessed 12 July 2025.

Converse, Nathan, et al. How ETFs Amplify the Global Financial Cycle in Emerging Markets. 2020. Federal Reserve Board, https://www.federalreserve.gov/econres/ifdp/files/ifdp1268.pdf. Accessed 12 July 2025.

Cox, Jeff. “Fed minutes May 2024: Concern over stubborn inflation.” CNBC, 22 May 2024, https://www.cnbc.com/2024/05/22/fed-minutes-may-2024-.html. Accessed 12 July 2025.

Fernandez-Arias, Nicolas, et al. “Emerging Markets Are Exercising Greater Global Sway.” IMF Blog, 2024, https://www.imf.org/en/Blogs/Articles/2024/04/09/emerging-markets-are-exercising-greater-global-sway. Accessed 12 July 2025.

Franklin Templeton Fixed Income. Cryptocurrencies and stablecoins: An emerging (market) story? Franklin Templeton, March 2025, https://franklintempletonprod.widen.net/content/qfiwj3abnm/pdf/cryptocurrencies-and-stablecoins-an-emerging-market-story.pdf. Accessed 12 July 2025.

Ghosh, Swati, et al. “Chasing the Shadows: How Significant Is Shadow Banking in Emerging Markets?” World Bank-Economic Premise, no. 88, 2012, pp. 1-7.

Haman, Ken, et al. “Emerging Markets: Finding Opportunities amid the Global Economic Reset.” AllianceBernstein, 20 May 2025, https://www.alliancebernstein.com/us/en-us/investments/insights/investment-insights/emerging-markets-finding-opportunities-amid-the-global-economic-reset.html. Accessed 12 July 2025.

International Monetary Fund. Research Dept. “Chapter 4 Shifting Gears: Monetary Policy Spillovers During the Recovery from COVID-19.” IMF eLibrary, 6 April 2021, https://www.elibrary.imf.org/view/book/9781513575025/ch04.xml. Accessed 12 July 2025.

Jobst, Andreas, et al. “Reverse currency war puts emerging markets at risk.” Allianz, Allianz, 29 September 2022, https://www.allianz-trade.com/en_global/news-insights/economic-insights/emerging-markets-debt-sustainability-risks.html. Accessed 12 July 2025.

Mammadov, Kanan. “Emerging Markets Face a Perfect Storm.” IMF PFM blog, 14 April 2025, https://blog-pfm.imf.org/en/pfmblog/2025/04/emerging-markets-face-a-perfect-storm. Accessed 12 July 2025.

Roncagliolo, Valerio, et al. “Impact of financial stress in advanced and emerging economies.” Journal of Economics, Finance and Administrative Science, vol. 27, no. 53, 2022, pp. 68-85.

Stauffer, Jason. “What The Fed Raising Interest Rates Means For Your Savings and Debt.” CNBC, 2025, https://www.cnbc.com/select/interest-rates-rising-saving-more-appealing-debt-more-harmful/. Accessed 12 July 2025.

UNCTAD. “Debt crisis: Developing countries' external debt hits record $11.4 trillion.” UNCTAD, 17 March 2025, https://unctad.org/news/debt-crisis-developing-countries-external-debt-hits-record-114-trillion. Accessed 12 July 2025.