- Pareto Tech Insights

- Posts

- Crypto Legislation in the U.S: Investment Implications of the GENIUS Act and Beyond

Crypto Legislation in the U.S: Investment Implications of the GENIUS Act and Beyond

What will be the economic and investment ripple effects of legislation like the GENIUS Act, the Clarity Act, and the Anti-CBDC Act?

Introduction

As Washington begins to lay the foundation for crypto regulation, investors need to ask one thing:

What will be the economic and investment ripple effects of legislation like the GENIUS Act, the Clarity Act, and the Anti-CBDC Act?

From stablecoins to tokenized assets, this isn’t just regulatory housekeeping — it’s a major turning point for digital finance.

Let’s dive into the evolving U.S. legal landscape and break down what it means for your portfolio.

What Is the GENIUS Act?

The GENIUS Act (short for “Guiding and Establishing National Innovation for U.S. Stablecoins Act”) is among the first serious attempts to give regulatory structure to stablecoins and digital assets.

Key Components:

Legal classification of certain stablecoins under a defined federal framework

Oversight mechanisms for issuer audits and reserve transparency

Requirements for U.S.-based custodians and bank-grade collateralization

The act signals Washington's readiness to embrace blockchain-backed finance — but on its terms.

What are the Next Key Bills?

Two key bills:

The Clarity Act

The Anti CBDC Act

The Clarity Act:

Aims to clearly distinguish between securities and digital commodities, helping protocols and investors know where they stand.

The Anti-CBDC Act:

Designed to block the creation of a U.S. Central Bank Digital Currency (CBDC) — citing privacy, control, and surveillance concerns.

Together, these bills show a shift from reactive enforcement to proactive crypto policy building.

Stablecoins: A Regulated Frontier Emerges

With the GENIUS Act now passed by Congress and heading to the White House, the U.S. is formalizing its stance on fiat-backed stablecoins — marking a pivotal moment in crypto regulation. The legislation is designed to establish a national framework for stablecoin issuance, aiming to mitigate systemic risk while fostering innovation.

Notable Players:

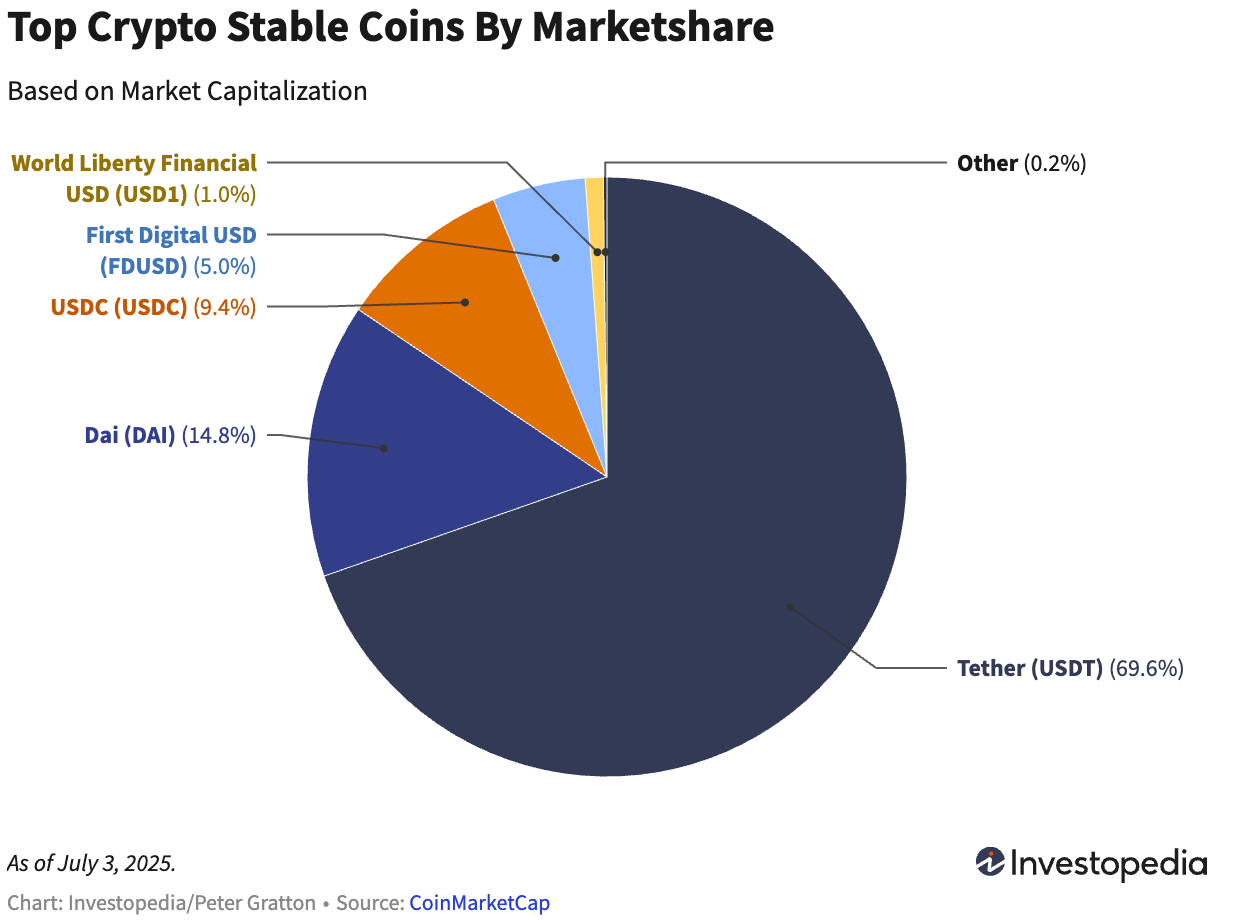

Figure 1: Top Crypto Stable Coins By MarketShare (Investopedia)

USDC (Circle): Well-positioned under the GENIUS framework due to its existing transparency and regulatory engagement. Circle has advocated for such legislation for years.

PYUSD (PayPal): PayPal's strong regulatory footprint and consumer trust make it an early winner in the “compliant-by-design” category.

USDT (Tether): While still dominant globally, Tether’s offshore structure and lack of U.S. regulation could limit its domestic presence as federal scrutiny tightens.

The GENIUS Act could usher in a wave of institution-grade stablecoins, enabling banks, fintechs, and asset managers to explore issuance in a regulated framework.

Tokenized Finance: Regulation’s Silent Catalyst

Stablecoins are increasingly seen as key infrastructure for tokenized asset settlements, including tokenized treasuries, equities, and private credit.

Why Tokenization Is Gaining Momentum:

Offers instant settlement, reduced counterparty risk, and enhanced transparency for everything from real estate to sovereign bonds.

Enables fractionalized access, opening previously inaccessible markets to global and retail investors.

Backed by real-world pilots from JPMorgan’s Onyx, BlackRock’s tokenized money market fund, and U.S. Treasury trial programs.

As Investopedia notes, “By requiring transparent, liquid backing for stablecoins, the GENIUS Act sets a precedent for how tokenized assets may eventually be structured and regulated”.

In essence, if stablecoins are the trusted cash layer, tokenized finance is what they’ll be used to settle — making it perhaps the most underappreciated investment opportunity in the post-GENIUS landscape.

Investment Strategy: What to Watch

Here’s how the evolving legislative landscape could shape your crypto allocation:

Stablecoins: Focus on USDC, PYUSD, and new entrants

Tokenized Assets: Look at platforms enabling tokenization

Altcoins: Short-term volatility risk

Risks: Regulatory Uncertainty, National Security & Market Fragmentation

A recent memo from the Senate Banking Committee highlights several strategic risks associated with the GENIUS Act’s current structure:

It limits federal oversight by allowing state regulators to approve stablecoin issuers, potentially creating a fragmented and exploitable system.

It may inadvertently open doors for foreign or adversarial entities to access U.S. financial infrastructure under loosely enforced state regimes.The Act excludes algorithmic and synthetic stablecoins but does not prevent private issuers from becoming systemic risks if they scale too quickly without proper monitoring.

The GENIUS Act focuses only on U.S.-domiciled, fiat-backed stablecoins. That leaves large offshore players like Tether (USDT) operating outside its jurisdiction, creating a fragmented global market. Investors may face inconsistent liquidity, cross-border regulatory arbitrage, and conflicting compliance standards, especially in emerging markets.

Global Effects

If the U.S. gets it right, crypto legitimacy could surge globally. If it fumbles, expect capital and innovation to migrate to friendlier jurisdictions.

The GENIUS Act might be U.S.-focused, but its success (or failure) will be felt everywhere from London to Singapore.

Final Takeaway

Whether you’re an LP, protocol founder, or everyday investor, understanding the intersection of crypto and regulation is now a core investment competency.

The next 6–12 months could set the tone for the next 10 years of digital asset growth.

Works Cited

Americans for Financial Reform Editors. “Factsheet: AFR Factsheet on The GENIUS Act's Flaws and Failures.” Americans for Financial Reform, 9 July 2025, https://ourfinancialsecurity.org/reports-publications/factsheet-afr-factsheet-on-the-genius-acts-flaws-and-failures/. Accessed 29 July 2025.

“Bipartisan Majorities in Two House Committees Vote to Advance the Digital Asset Market CLARITY Act of 2025.” Morgan Lewis, 2025, https://www.morganlewis.com/pubs/2025/06/bipartisan-majorities-in-two-house-committees-vote-to-advance-the-digital-asset-market-clarity-act-of-2025. Accessed 29 July 2025.

Carter, Sandy. “GENIUS Act Passes As Stablecoin Rules Head To The White House.” Forbes, 17 July 2025, https://www.forbes.com/sites/digital-assets/2025/07/17/genius-act-passes-as-stablecoin-rules-head-to-the-white-house/. Accessed 29 July 2025.

Cunningham, Mary. “Stablecoins get a big boost as Trump signs the Genius Act. Here's what to know.” CBS News, 18 July 2025, https://www.cbsnews.com/news/the-genius-act-vote-what-is-stablecoin-bill-crypto-cbs-news-explains/. Accessed 29 July 2025.

Hrdy, Alice S. “GENIUS Act Passes: US Stablecoin Law Explained.” Morgan Lewis, 17 July 2025, https://www.morganlewis.com/pubs/2025/07/genius-act-passes-in-us-congress-a-breakdown-of-the-landmark-stablecoin-law. Accessed 29 July 2025.

Newbery, Emma. “3 Concerns Investors Have if the Cryptocurrency-Focused Genius Act Becomes Law.” The Motley Fool, 30 June 2025, https://www.fool.com/investing/2025/06/30/3-concerns-investors-have-if-the-cryptocurrency-fo/. Accessed 29 July 2025.

United States Committee on Banking, Housing, and Urban Affairs. “The GENIUS Act Risks U.S. National Security.” The GENIUS Act Risks U.S. National Security, 2025, https://www.banking.senate.gov/imo/media/doc/The%20GENIUS%20Act%20Risks%20U.S.%20National%20Security.pdf. Accessed 29 July 2025.

Velasquez, Vikki, and Peter Gratton. “What Passage of the 'GENIUS Act' Means for Stablecoins.” Investopedia, 21 July 2025, https://www.investopedia.com/the-genius-act-impact-on-stablecoins-11765112. Accessed 29 July 2025.

Wile, Rob. “Genius Act: What new crypto law could do, stablecoins explained.” NBC News, 18 July 2025, https://www.nbcnews.com/tech/crypto/genius-act-new-crypto-law-stablecoins-explained-rcna219658. Accessed 29 July 2025.