- Pareto Tech Insights

- Posts

- Crypto ETFs: Institutional Breakthrough or Just Another Wall Street Play?

Crypto ETFs: Institutional Breakthrough or Just Another Wall Street Play?

Diagram 1 - Bitcoin ETF Trend in 2024 (YCharts, 2024)

Crypto exchange-traded funds (ETFs) are rapidly transforming the digital asset landscape, bridging the gap between traditional finance and the crypto markets. As shown in diagram 1, Bitcoin ETF has been experiencing unprecedented growth. By offering regulated, accessible exposure to cryptocurrencies, ETFs are drawing in institutional capital at an unprecedented scale.

But as Bitcoin ETFs surpass $136 billion in assets under management, and firms like BlackRock, Fidelity, and Grayscale dominate the market, a critical question emerges: Are crypto ETFs truly democratizing investment, or are they centralizing control over digital assets?

The Crypto ETF Boom: A Game-Changer for Institutions

Diagram 2 - Crypto ETF Liquidity Provider Market Share as of Q2 2024 (Fideres, 2024)

As shown in diagram 2, the Crypto ETF is held by various liquidity providers. The launch of spot Bitcoin ETFs in early 2024 was a turning point. BlackRock’s iShares Bitcoin Trust (IBIT) reached $1 billion in volume within days, and soon after, major asset managers rolled out competing products.

Key developments fueling the ETF surge:

Market acceptance: Crypto ETFs now hold over $136 billion in assets.

Increased accessibility: Investors can gain exposure to Bitcoin without needing direct custody or navigating crypto exchanges.

Growing product diversity: Asset managers are now seeking SEC approval for Ethereum, Solana, and XRP ETFs.

Traditional finance has fully entered the crypto space—but is this a step toward broader adoption or just another way for Wall Street to consolidate control?

Volatility & Risk: Are ETFs Really Safer?

Diagram 3 - Crypto ETF VS. Cryptocurrency (CenterPoint Securities, 2024)

As the similar trend shown in diagram 3, while ETFs provide an easy way to invest in crypto, they do not eliminate the risks inherent to the asset class.

Market swings remain severe: In February 2025, Bitcoin fell 17.2% in one week, leading to $3.3 billion in ETF outflows as institutions rushed to de-risk.

Crypto ETFs lack fundamental anchors: Unlike traditional stock ETFs, they do not include dividends or balance sheets to stabilize valuations.

Liquidity risks persist: Large redemptions from major ETFs could amplify volatility, rather than cushion against it.

For institutional investors, ETFs offer exposure, not protection—crypto’s speculative nature remains unchanged.

Regulatory Uncertainty: The Wild Card in Crypto ETFs

Regulators have long been wary of crypto ETFs due to concerns over market manipulation and investor protection. While 2024 saw the approval of Bitcoin ETFs, SEC Chair Gary Gensler warned of heightened scrutiny, particularly around:

Custody risks—How safely are assets held, and by whom?

Fraud concerns—Will ETF providers face stricter compliance measures?

Future restrictions—If regulations tighten, could institutional adoption stall?

If regulators impose heavy restrictions, the growth of crypto ETFs could slow, limiting their impact on broader financial markets.

A New Era: Beyond Bitcoin ETFs

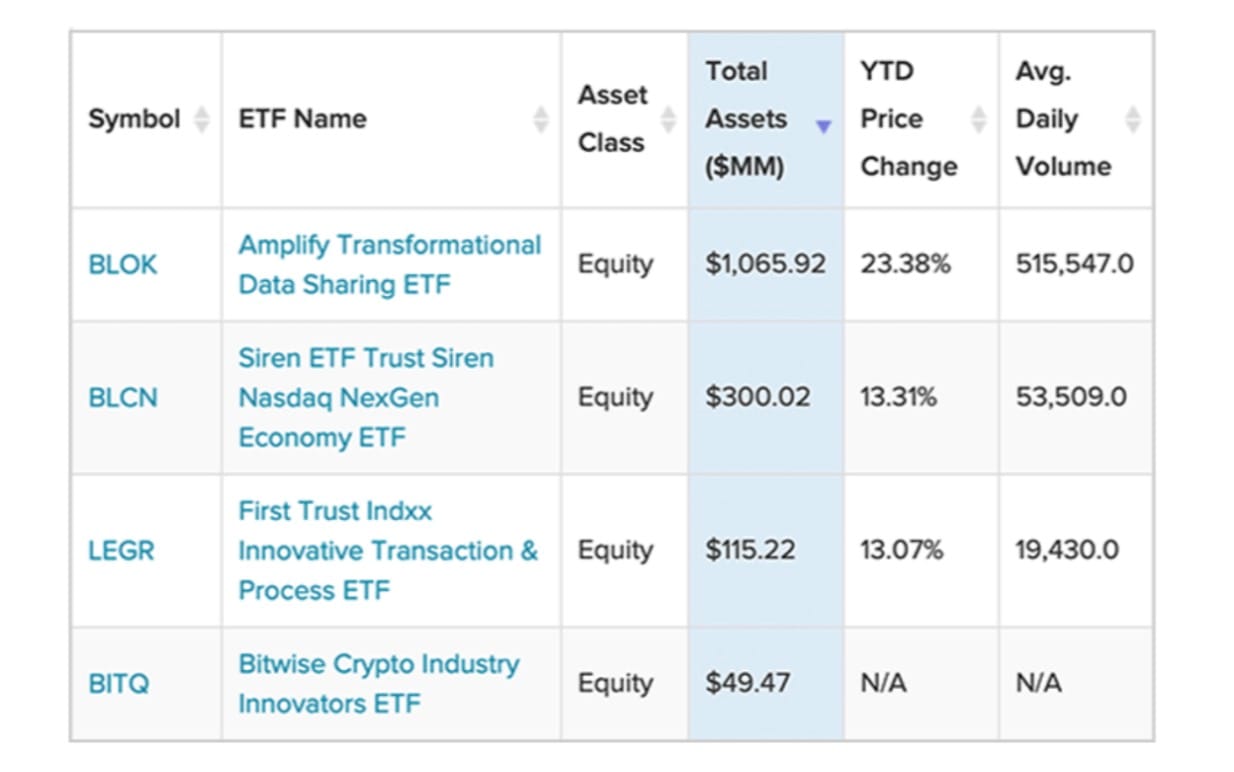

Diagram 4 - Popular Crypto ETFs (Appinventiv, 2024)

As shown in diagram 4, the Crypto ETF has a great asset amount and daily volume. Bitcoin ETFs are just the beginning. The next wave of ETF products could reshape the crypto market:

Ethereum ETFs—Expected to launch in 2025, with potential exposure to staking rewards.

DeFi-Indexed ETFs—Tracking major DeFi protocols like AAVE, Uniswap, and MakerDAO.

Yield-Bearing ETFs—Incorporating staking, lending, and tokenized assets for passive returns.

Hybrid ETFs—Blending tokenized real-world assets (RWAs) with digital assets like Bitcoin.

These innovations could further integrate crypto into traditional finance, but institutional dominance in the ETF space could limit retail investors’ ability to access DeFi-native rewards.

Final Thought: A Bridge or a Barrier?

Diagram 5 - Crypto ETF Benefits & Limitations (CenterPoint Securities, 2024)

As shown in diagram 5, Crypto ETFs are a double-edged sword. They provide a familiar, regulated way for institutional capital to enter the space—but they also shift control of digital assets to Wall Street.

For retail investors, ETFs offer convenience but strip away access to staking rewards, DeFi opportunities, and direct blockchain participation. The question remains: Will ETFs bring crypto into the mainstream—or will they reshape the market in favor of financial giants?

What do you think? Reply and share your thoughts.

Enjoyed this breakdown? Subscribe for more insights on blockchain, DeFi, and the evolution of crypto markets.

Works Cited

Appinventiv. "Investment in Blockchain ETF vs Bitcoin ETF: What’s the Difference?" Appinventiv, 2024. Retrieved from https://appinventiv.com/blog/investment-in-blockchain-etf-vs-bitcoin-etf/

"Bitcoin rout amplified by record ETF outflows, traders say - what investors need to know about 'faster money'." MarketWatch, 2 March 2025. Retrieved from https://www.marketwatch.com/story/a-bitcoin-rout-accompanied-by-record-etf-outflows-what-investors-need-to-know-about-faster-money-1266407e

"Bitcoin Went Mainstream in 2024. Are Ether, Solana and Other Risky Tokens Next?" Wall Street Journal, 2024. Retrieved from https://www.wsj.com/finance/currencies/cryptocurrency-future-bitcoin-popularity-cc3a977f

"BlackRock's Bitcoin ETF Is First to Cross $1 Billion Threshold in Inflows." Bloomberg, 18 January 2024. Retrieved from https://www.bloomberg.com/news/articles/2024-01-18/blackrock-s-bitcoin-etf-is-first-to-cross-1-billion-threshold

CenterPoint Securities. "How Does a Crypto ETF Work?" CenterPoint Securities, 2024. Retrieved from https://centerpointsecurities.com/how-does-a-crypto-etf-work/

"CME Group plans to launch Solana futures on March 17." Reuters, 28 February 2025. Retrieved from https://www.reuters.com/business/finance/cme-group-plans-launch-solana-futures-march-17-2025-02-28/

"Crypto ETFs set to trump precious metal peers, says State Street." Financial Times, 3 March 2025. Retrieved from https://www.ft.com/content/bc2f1484-1cd8-41d7-85e8-6ad9c754d611

Fideres. "Crypto ETFs: A Simple Concept with Big Issues." Fideres Partners, 2024. Retrieved from https://fideres.com/crypto-etfs-simple-concept-big-issues/

"SEC Crypto ETF Approval: A New Era for Institutional Bitcoin Investment." CNBC, 12 January 2024. Retrieved from https://www.cnbc.com/2024/01/12/sec-crypto-etf-approval-analysis.html

YCharts. "Navigating the New Era of Bitcoin ETFs with YCharts." YCharts Blog, 2024. Retrieved from https://get.ycharts.com/resources/blog/navigating-the-new-era-of-bitcoin-etfs-with-ycharts/